Financial Planning Advice - How To Properly Set Up Your Budget!

Financial Planning Advice - How To Properly Set Up Your Budget!

Blog Article

Everybody are unable to understand a lot of the dreams that we have in our lives. This is because we get captured up in our work, organization, we fret a lot and we tend to postpone things for a while. We believe that we will find the time for all those things when we retire. People have various dreams about retirement. Some dream of going and living in the green country side while for certain others the dream retirement is taking a cruise around the world. Whatever is your huge retirement dream, to make that dream real you need a significant quantity of planning and conserving.

Females do not work as long as guys do at the very same task. This is because of requiring time off to take care of the family to raise the kids. So females don't build up the needed years to get approved for a sizable pension or retirement strategy, leaving them with little or no savings from the companies they are working for.

The 50-60 age group is choosing if they want to change professions, change their life objectives, or remain in what they are doing today. They are at that midway place in their lives where they are preparing for their long-lasting objectives.

There are numerous great retirement planning calculators online that you can use to see where you presently stand in your goals for retirement. These online calculators are very easy to use and must only be think about as a guide only. The expect the majority of the companies providing you with these complimentary retirement planning calculators is that you will contact them to help you in producing a solid retirement plan.

Saving isn't enough. The old rule stated that if you saved routinely you would be rewarded with a comfortable retirement through the effect of intensifying. Offering you with the nest egg you require to retire.

Starting your life journey might be the very first of lots of things for you: your very first full-time job, first flat. The understandable desire may be to spend, invest, invest. And many will enter into financial obligation to fund more research studies or to purchase an automobile but if you manage things from the start you are less likely to enter severe issues. So are you game to start preparing at 18?

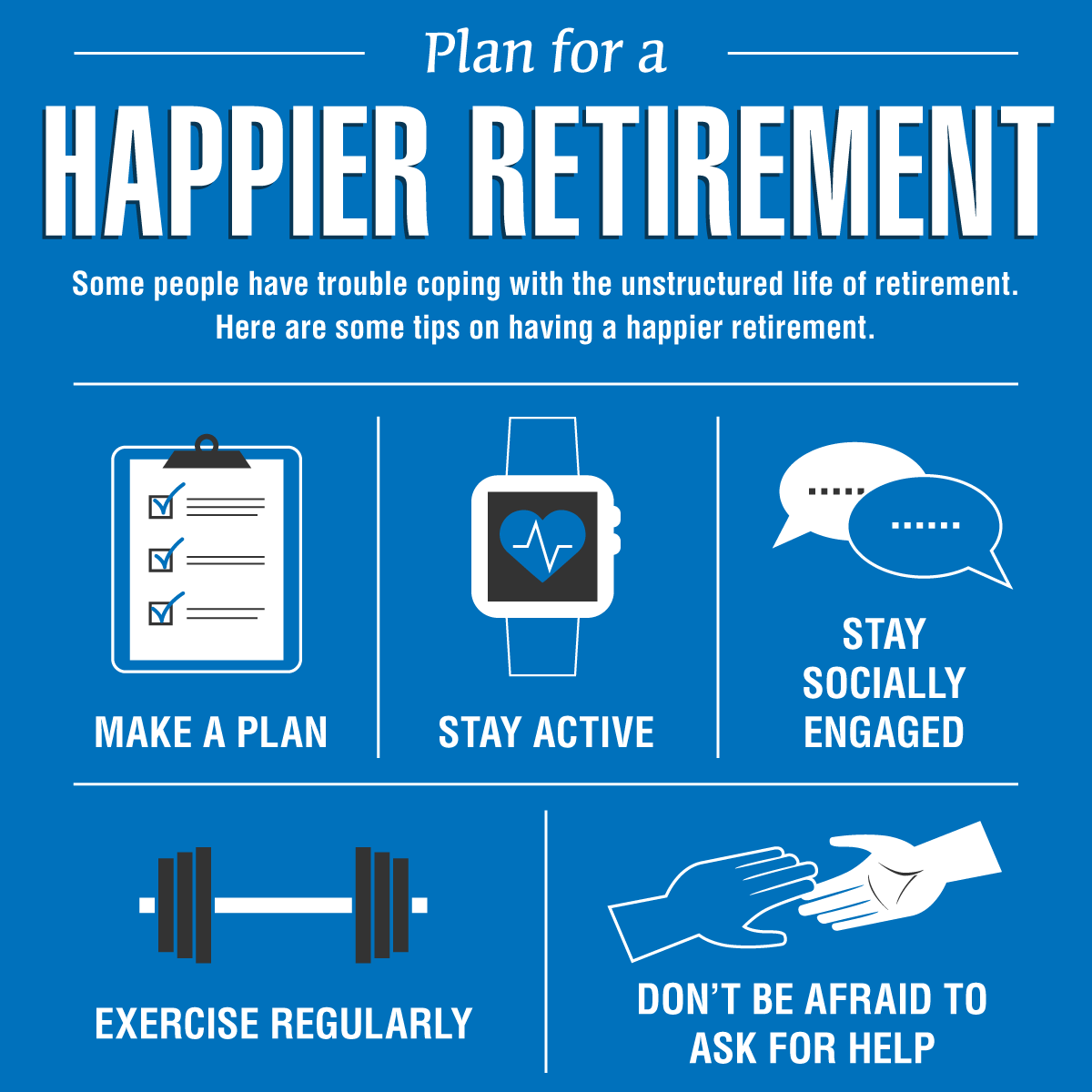

How can I accomplish my objectives when I am retired? Too frequently advisors focus on the 'just how much' concern and forget that individuals still have objectives and goals when they retire. There requires to be more what, when, where questioning.

The answers to any of these concerns about retirement planning will depend upon your particular scenarios and the retirement plan assessment done by your monetary consultant. Ask the concerns and follow your plan.